This article originally appeared in the August 2021 edition of Senior Scope. Article and graphic by Seth Thomas.

Whether it’s a robocall, junk mail or an email from a stranger who needs you to send them money urgently, avoiding scams has become an everyday part of life.

Unfortunately, scammers constantly update and change their techniques to try to swindle you out of money or gain access to your personal information.

Throughout the pandemic, the Federal Trade Commission (FTC) issued numerous alerts, warning the public that scammers were taking advantage of the chaotic situation, whether it was through false claims about the vaccine, emails purporting to be from the Centers for Disease Control and Prevention, or bogus calls from people claiming to be contact tracers.

With society slowly reopening, representatives from Attorney General Maura Healey’s office recently visited the Rochester Council on Aging to provide an update on the latest strategies scammers use to exploit victims. Below are several types of scams to look out for.

Phishing scams:

Scammers will try to gain access to your personal information through email or text messages. These messages may appear to be coming from a legitimate source – they may even illegally use the logos of real companies or government agencies.

Phishing scams will often tell you a story (such as, “You’ve won a gift card from Amazon!”) and ask you to open an attachment, click on a link or enter personal information.

Should you receive such a message, do not click on the links or open the attachments. The Federal Trade Commission recommends first asking yourself if you have an account with the company. If you don’t, it’s likely a scam. If you do, contact the company using a phone number or website you know is real.

When in doubt, delete the message. As Marcony Almeida-Barros, the director of the Community Division at the Attorney General’s office, reiterated throughout the presentation: if it seems to good to be true, it is.

To help prevent these messages from appearing in the first place, ensure that your computer and phone have the latest security updates. You can even set up your computer or phone to update automatically.

Classified scams:

The AG’s Office said that during the pandemic, they received many calls regarding phony online classified ads for apartments.

Because of social distancing protocols, landlords would photograph or take video footage of the inside of properties because they were unable to meet with potential renters for an in-person tour. Scammers would take this footage from legitimate online classified ads, and create phony listings of their own.

The first red flag to look out for: these fake listings won’t add up. For instance, the ad might promise a spacious, multi-room apartment at a bargain price. The scammer might ask the would-be tenant for a payment up front, usually through a wire transfer, and promise to deliver the keys at a later date.

Almeida-Barros cautioned that if you can’t see an apartment in person, do not pursue it. The images and videos you see online might not reflect reality. Also, be wary of using wire transfer companies to make payments. Paying through traceable means – like a check, which can be stopped through your bank – is always the better option.

Offline Scams:

While many scams happen through the internet, there are still plenty of scams happening offline. These scammers are searching for any personal information they can glean from you, whether it’s your Social Security number, insurance ID number or even your customer ID number on a utility bill.

The Attorney General’s office recommends that if you receive a letter in the mail that seems fishy, start by reading the fine print, which usually appears at the bottom of the letter. The same rule applies for contracts.

During the presentation, Almeida-Barros read from a letter that a patron of the COA had brought with them that morning. The letter used urgent language (“Immediate response requested!”) and claimed that the recipient needed to contact the company in order to “activate a car service contract.”

The body of the letter seemed to imply that the car owner’s insurance was expiring. But the minuscule, hard-to-read fine print at the bottom of the letter revealed that the company was unaffiliated with any manufacturer or dealer. A quick Google search of the ZIP code on the envelope revealed that the letter had come from Missouri.

The “company” was likely a scammer looking for the recipient to mail them back a form filled with personal information. Always guard your personal information. That includes your name, address, Social Security number or health insurance ID number. In addition to checking the fine print of letters like these, the Attorney General’s office also recommends performing thorough research and taking your time before signing any form or contract.

Other steps you can take to avoid scams:

- Know who you are dealing with when you’re giving away your personal information

- Do not post identifying information (including your COVID-19 vaccine card) on social media, like Facebook

- Shred documents, do not just throw them in the recycling bin or trash can

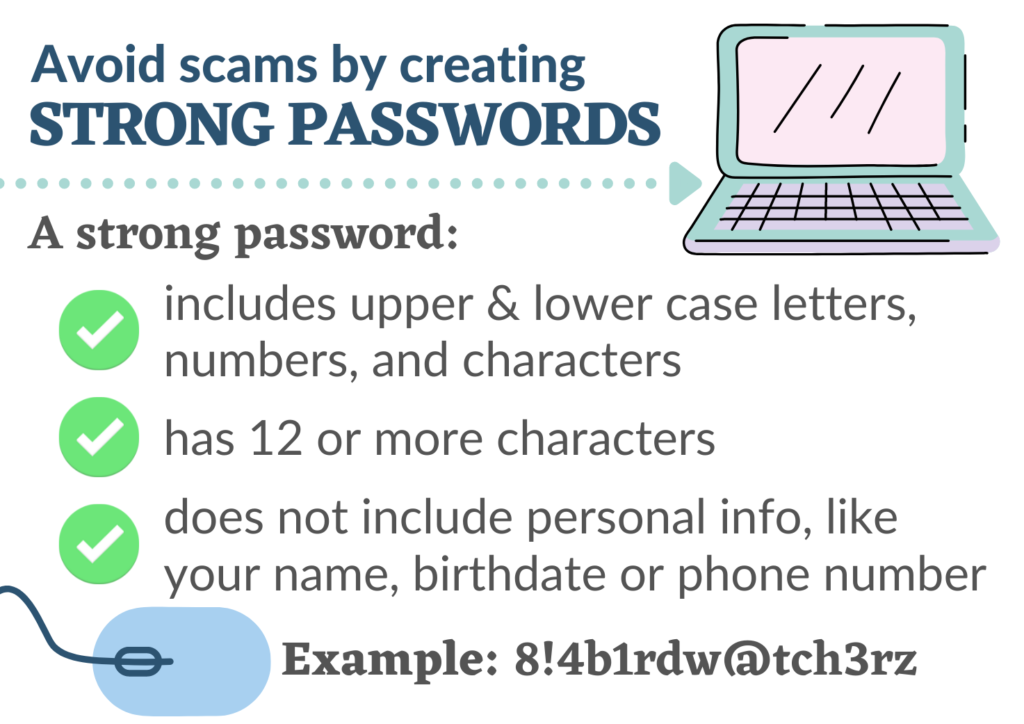

- Change your passwords regularly, and use strong passwords

And remember: even if you’ve spotted fraud and have avoided a scam, it’s important to file a report. You never know if the state or the federal government is building a case against an individual or a company suspected of fraud. Your report could help stop a scammer.

Resources

- To report a scam or fraud, file a complaint with Federal Trade Commission by calling 1-877-382-4357.

- To report an email scam, file a complaint with the FBI at ic3.gov.

- If you’re having issues with a business in Massachusetts, contact the Attorney General’s Consumer Advocacy & Response Division at 617-727-8400 or mass.gov/ago.

Recent Comments